In a move that could significantly reshape the United States regulatory landscape for cryptocurrencies and digital assets, Paul S. Atkins has officially been sworn in as the 34th Chairman of the U.S. Securities and Exchange Commission (SEC).

The announcement was confirmed via an April 21 press release from the SEC, signaling a potential shift in tone and policy under new leadership.

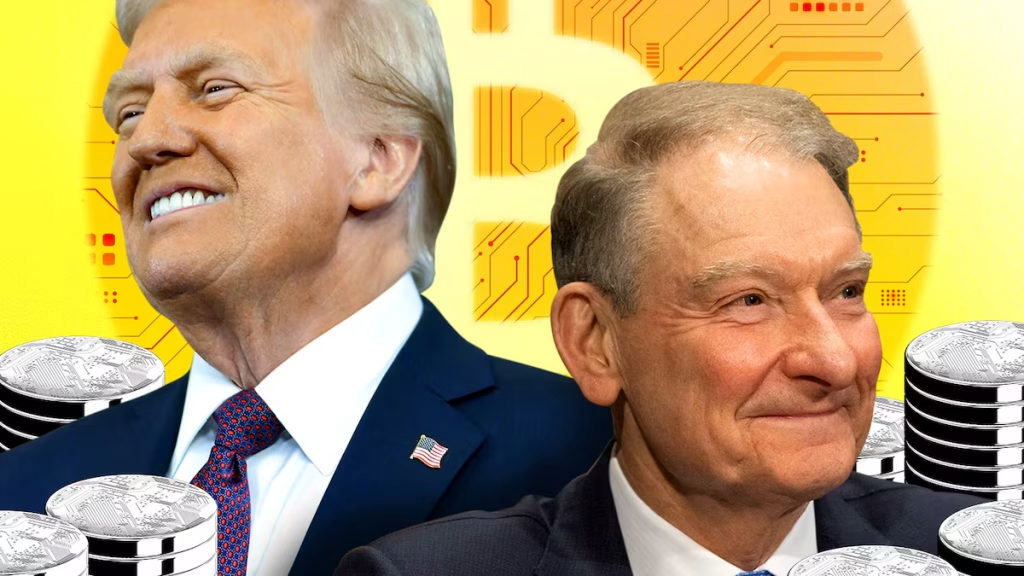

Atkins, a seasoned figure in financial regulation, was nominated by President Donald Trump on January 20 and confirmed by the Senate earlier this month. His return to the SEC comes with notable experience, having previously served as a commissioner from 2002 to 2008 during the George W. Bush administration.

More recently, Atkins has been active in the private sector, leading Patomak Global Partners—a regulatory advisory firm—and working closely with various blockchain and fintech startups. His crypto credentials run deep: he co-chaired the Token Alliance and has served as an expert witness in crypto-related court cases.

READ ALSO: Chelsea Manager, Enzo Maresca Hit with One-Match Ban

Ethics disclosures show Atkins and his wife hold assets valued between $327 million and $588.8 million, with approximately $6 million tied to digital assets.

Prior to his confirmation, he committed to divesting his stakes in crypto-related entities including Anchorage Digital, Securitize, and a $5 million limited partnership interest in Off the Chain Capital.

In his official statement, Atkins said: “I am honored by the trust and confidence President Trump and the Senate have placed in me to lead the SEC. Together we will work to ensure that the U.S. is the best and most secure place in the world to invest and do business.”

READ ALSO: Paris Pays Tribute to Pope Francis: Eiffel Tower Lights to Go Dark in His Honor

During his Senate confirmation hearing in March, Atkins openly criticized the previous SEC leadership under Gary Gensler, calling their approach to crypto regulation “vague” and “overly aggressive.”

He pledged to reduce political influence within the agency, support clearer rules for digital assets, and foster an environment more conducive to capital formation.

Industry analysts are calling his appointment a pivotal moment for the SEC. Many believe Atkins will pivot the agency away from a primarily enforcement-driven stance to one focused on clarity, collaboration, and innovation.

Expectations are building around faster approvals for crypto-based exchange-traded funds (ETFs), more transparent guidance for token issuers, and a friendlier regulatory tone.

This leadership change comes at a time when major crypto firms like Coinbase, Circle, and Paxos are reportedly eyeing U.S. banking licenses, buoyed by what insiders describe as a more open and constructive climate in Washington. Several ETF applications also remain in limbo, awaiting the green light from the newly led SEC.

As Atkins steps into his role, the crypto industry is watching closely. If his track record and promises are any indication, the coming months could usher in a new chapter—one where innovation and investor protection may finally find common ground.

Discover more from Scoop Hub

Subscribe to get the latest posts sent to your email.